IRR formula: What it is and how to use it

Real estate is a way to diversify your investments, but it also carries substantial risk. According to the Financial Industry Regulatory Authority (FINRA), risk level typically correlates with the level of potential reward.

Part of the risk involved with investment decisions is the unknown. There is no crystal ball that will reveal the profit or loss your investment will produce in five years, but there are tools you can use to try to evaluate risk and project potential return—one of which is the IRR formula.

Table of contents

What is IRR and why is it important? What is the difference between IRR, ROI, and cash-on-cash return? What is the IRR formula? Example of IRR applicationHow to interpret IRR Limitations of IRRWhat is IRR and why is it important?

When investing in real estate, it is important to understand how the property could increase in value or yield income, as well as the amount of time it would take to recognize those gains. To determine potential profits, you must account for the “time value of money,” or how the value of money changes over time based on inflation, opportunity cost, and risk. Future profits must be “discounted” in order to calculate the present value, as money is understood to depreciate over time.

That’s why the formula for internal rate of return (IRR for short) is helpful—because it accounts for fluctuations in the value of money on an investment, whereas other formulas do not. IRR is a discounted cash flow analysis. It is the discount rate at which the net present value (NPV) of an investment or project is zero. For further clarity, here are some helpful definitions:

Discount rate: The rate of return used to reduce future cash flows to the value that they would be today. Example: $100 invested today with a 20% return on investment would yield $120 in the future. Working backwards, a future value of $120 at a discount rate of 20% would yield a present value of $100.

Net present value (NPV): The value of all present and future cash flows, including initial investments and future profits, over the lifespan of an investment or project. Example: Net present value equals any revenue minus any expenses.

Zero-sum: The goal of the IRR formula is to determine the present-day rate at which your investment or project would break even, or equal zero. Example: If your real estate investment costs $200,000 in cash and you anticipate an annual revenue of $50,000, you could expect to break even in your fourth year.

IRR—presented as a percentage—is used in financial analysis to determine the potential profitability of an investment, or the rate of return it is projected to generate annually.

The formula remains uniform across investment types by taking into account a series of cash flows and the time value of money. This means that an investor or company can use IRR along with other profitability determinants to more accurately compare the value of different investments with similar characteristics.

For example, if you are deciding whether to invest in an entirely new property or expand an existing one, IRR can help you determine which venture would be most lucrative.

What is the difference between IRR, ROI, and cash-on-cash return?

IRR, ROI, and cash-on-cash return—also called CoC return—are all metrics used by real estate investors to determine the profitability of an investment. The differences between the three lie in what you’re solving for.

ROI, or the return on investment, reflects the total profitability of an investment, but unlike IRR, it doesn’t account for the length of time or changes in value. It is presented as the total percent increase or decrease of an investment over the time that it is held.

IRR, on the other hand, shows profitability on an annual basis. While IRR and ROI may yield similar results in the first year, IRR will produce a more accurate depiction of an investment or project’s long-term consequences.

CoC return, however, is the best indicator of profitability when debt is involved. Like IRR, CoC return is calculated on an annual basis. But since real estate is not commonly purchased in all cash, CoC helps investors determine return only on the cash invested, excluding the debt borrowed.

What is the IRR formula?

This is the IRR formula:

NPV = Net present value

N = Total number of time periods (e.g., if you plan to work on a project for five years, N = 5)

n = Time period (e.g., for the first year of a project, n = 1)

CF0 = Initial investment

CF1, CF2, CF3, etc. = Cash flows (i.e. income or investments)

IRR = Internal rate of return

Calculating the internal rate of return with pencil and paper can be complicated and time consuming. The NPV is calculated using estimated interest rates, so manually, you would need to use trial and error to determine the IRR. Luckily, there is a handy function available on Microsoft Excel and Google Sheets that allows you to enter your time frames and cash flows to more efficiently determine the rates of return on an annual basis.

In fact, there are three different IRR functions that can determine the rate, depending on how much you know up front about the investment.

IRR function: Used to calculate the rate of return for a series of cash flows with equal-sized payment periods.

XIRR function (extended internal rate of return): Used to calculate the rate of return for a series of cash flows with different-sized payment periods, which can yield a more accurate rate than the standard IRR function.

MIRR function (modified internal rate of return): Used to calculate the rate of return for a series of cash flows while factoring in the cost of borrowing the initial investment and compounded interest produced by reinvesting cash flows.

When it comes to the calculations, IRR is the most basic, while XIRR and MIRR provide more nuanced results. To create the most well-rounded estimation of the potential profitability of an investment, it’s best to calculate all three functions.

Example of IRR application

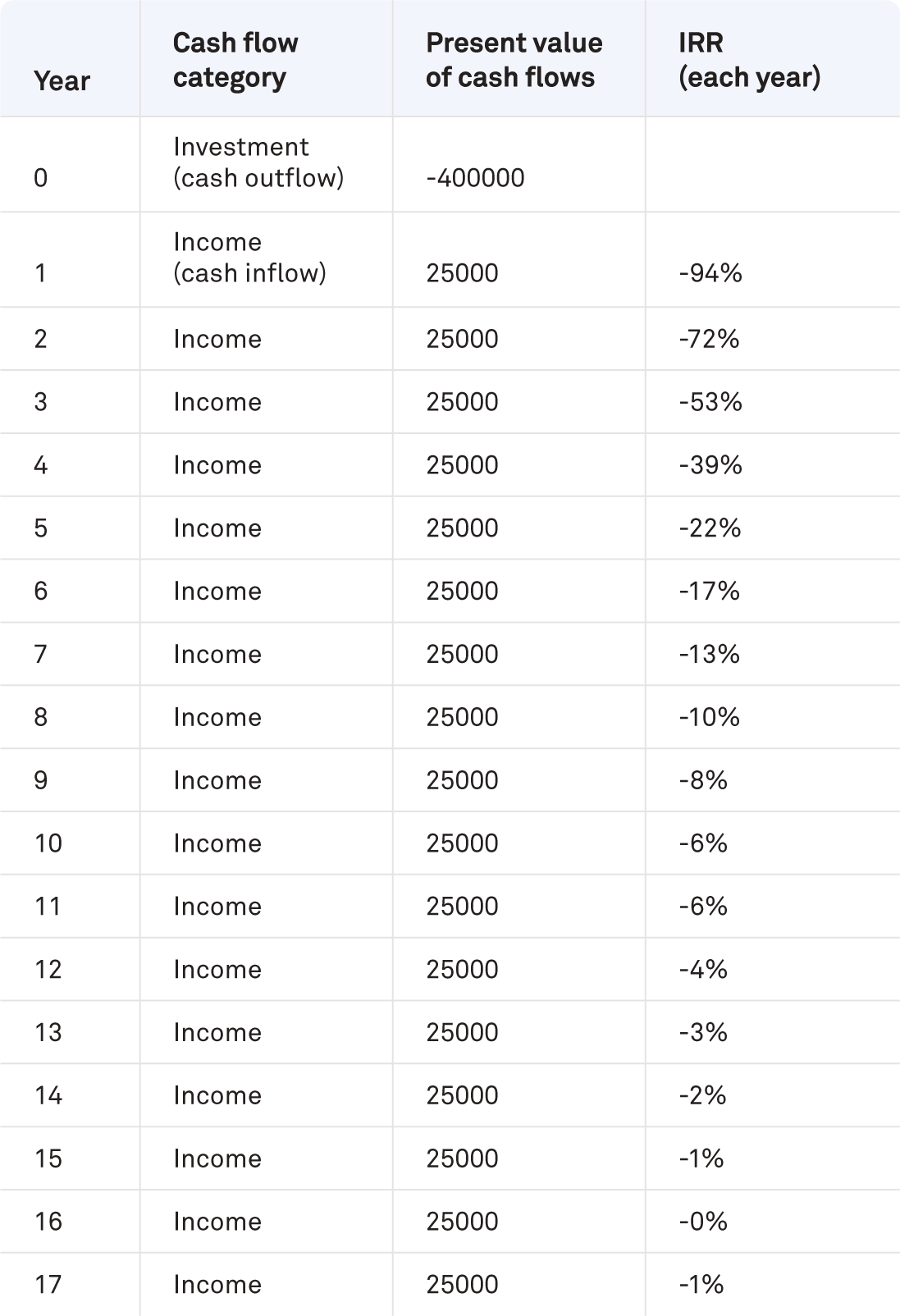

Imagine you purchase a piece of property in all cash for $400,000. This is considered cash outflow. You expect to rent the unit for $2,000-$2,100 per month, which yields $25,000 in annual profit. This is considered cash inflow.

Using the Excel formula, you can see that you are not expected to break even on your investment until year 16. In year 17, you can estimate a 1% rate of return and so on.

How to interpret IRR

In general, the higher the IRR, the better the investment opportunity is. However, since IRR is a percentage and not a dollar amount, the rate won’t always show the full picture. Two potential investments can have similar IRRs but different profits determined by their cash flows and time periods.

For instance, Property A could cost $200,000 up front and break even by year four with a consistent $50,000 per year in revenue, whereas Property B might cost $100,000 and break even at the same time with $25,000 per year in revenue. The year-to-year IRR values would be the same, but the revenue of Property B would be half that of Property A. For this reason, it is important to take into account several measures of profitability, such as NPV and required rate of return (RRR).

The RRR is the minimum amount necessary for an investor to make in relation to the property’s level of risk. The larger the difference between the IRR and the RRR, the more profitable the project will be. Although a higher IRR could indicate a higher-reward investment opportunity, it can also involve more risk, so you should also interpret IRR against your own willingness to accept risk.

Limitations of IRR

IRR is used in capital budgeting to help investors decide whether or not to invest based on how profitable the asset is projected to be. However, there are several limiting factors of IRR.

IRR is based on estimates, so it should only be used as a guide and in conjunction with other measures that calculate return.

The rate presents a limited view when comparing investments or projects with different characteristics, such as varying time periods. You cannot accurately compare a project with a one-year duration to another with five years using only IRR.

Bungalow is the best way to invest and manage your real estate portfolio. We work with you to identify, purchase, fill, and manage residential properties—so that you can enjoy up to 20% more in rental income with a lot less stress. Learn more about Bungalow.

Ready to find your next home?

Move-in ready homes and a built-in community so you can feel at home, together — wherever you are.

Suggested articles