What you need to know about rental property depreciation

Owning a rental property can offer a host of financial advantages and rental property tax reductions. When the property is rented, it provides a steady flow of income. The tax owed on rental income can be lowered by deductions for costs such as insurance, property taxes, and property maintenance. And real estate tends to gain value, meaning you might be able to sell for a profit.

There’s one more plus: depreciation, which reduces the tax bill of the investor for the life of the property.

Table of contents

What is depreciation? 3 key IRS provisions for rental property ownersCalculating a rental property’s cost basisAdjusting for land valueAdjusting for time-ownedOther adjustmentsThe useful life of a rental propertyExample of rental property depreciationWhat if a property doesn’t depreciate?Correcting past mistakesWhat is depreciation?

The cost of a physical asset can be absorbed over time as it wears out, not all at once when it’s purchased.

For example, a business buys a laptop for $2,000 and it has an expected useful life of five years. Internal Revenue Service rules would allow it to be depreciated by $400 a year. This amount can be used to offset revenue, helping to lower the business’s annual tax bill. Similar rules apply to rental properties.

3 key IRS provisions for rental property owners

Before assuming you can benefit from depreciation, real estate investors need to make sure they meet the IRS’ requirements:

You own the property. You can’t take a write-off for property that you lease and then sublet. Note, however, that for the IRS’ purposes, you own a property even if there is a mortgage on it.

The property must generate income, typically through rent. You cannot take a write-off on a home you live in, though portions, like a home office, may generate income and qualify for the deduction.

The property must be used for more than one year. If you buy and sell a rental property in the same year—say by fixing and flipping it—you can’t write it off.

Calculating a rental property’s cost basis

The cost basis is the calculated value of the asset that is subject to depreciation. This is not simply the purchase price. It is the price once necessary deductions and additions are made. The cost basis sometimes needs to be adjusted after a property is purchased. For example, if you spend $50,000 to repair or renovate a property, that expense will be added to the cost basis.

Some other expenses can be included in the cost basis when the investor buys the property, such as lawyer’s fees, transfer taxes, property survey fees and other closing costs. Any debt that the buyer assumes from the seller can also be added to the cost basis.

Adjusting for land value

Depreciation write-offs are only allowed for buildings, not the land on which they sit, as land doesn’t typically lose its value through wear and tear. When calculating the cost basis of a rental property it is necessary to deduct the value of the land.

Example: If a home is purchased for $250,000, but an appraisal determines that the land it sits on is worth $50,000, then the cost basis is $200,000.

Adjusting for time-owned

The cost basis will typically be adjusted over time. If after you have owned the property for several years you decide to spend $50,000 repairing or renovating it, that figure will be added to an adjusted cost basis.

Other adjustments

Other than land value, here are some of the other expenses that can be included in calculating the cost basis when the property is purchased:

Lawyer’s fees

Transfer taxes

Property survey fees

Other closing costs

Debt that the buyer assumes from the seller

The useful life of a rental property

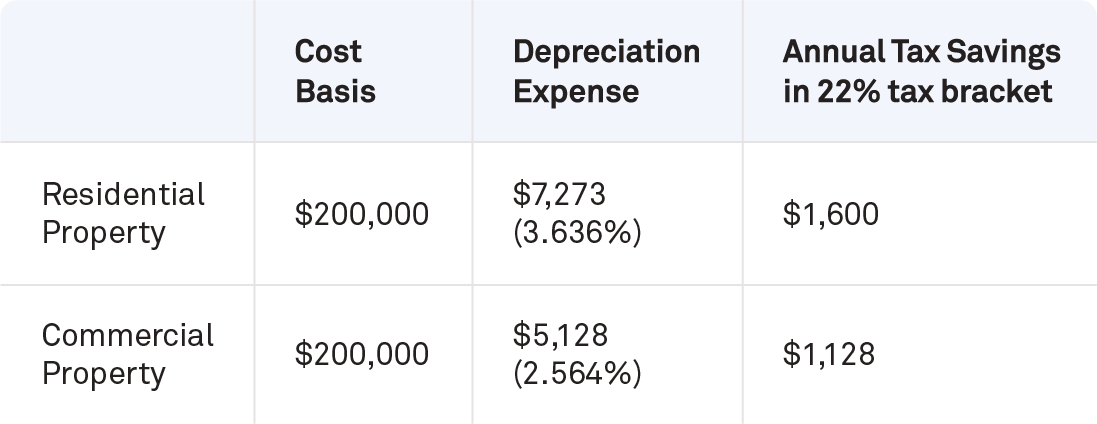

For tax purposes, the IRS assumes that residential properties have a determinable useful life of 27.5 years and commercial properties of 39 years. That means that each year the depreciation expense for a residential property is 3.636%, while it’s 2.564% for commercial properties.

Example of rental property depreciation

To use the figures above, a residential rental property with a cost basis of $200,000 would have an annual depreciation expense of $7,273. A commercial property with the same cost basis would have a depreciation expense of $5,128.

If you are in the 22% tax bracket, to pick one example, the depreciation expense on a residential property with a cost basis of $200,000 would lower your tax bill by $1,600. The annual tax savings due to the depreciation expense on a commercial property with the same cost basis would be $1,128.

What if a property doesn’t depreciate?

An old pickup truck rarely is worth more than a new one, but it is common for a rental property in a desirable area to gain value. If the owner of the residential rental property with a cost basis of $200,000 is able to sell it after 10 years for $400,000, they will be subject to a depreciation recapture tax designed to recoup the tax deductions that the owner enjoyed.

One possible way to avoid paying tax on a sale is to replace one investment property with another one without the owner ever pocketing the proceeds. This is called a 1031 exchange.

Correcting past mistakes

Although depreciating a rental property is voluntary, the IRS doesn’t see it that way if you sell. The IRS will assume at the time of a sale that you have been taking the deduction and will expect you to pay a depreciation recapture tax, if necessary.

If you failed to calculate the depreciation when you should have, you can file amended tax returns for mistakes going back up to three years. For older errorsI, you’ll need to complete IRS Form 3115, or the Application for Change in Accounting Method.

In any event, the rules governing depreciation and deductions for rental properties can get very technical, and they do sometimes change. For those reasons, an investor needs to work with a tax accountant on managing the tax treatment of any rental property.

Bungalow is the best way to invest and manage your real estate portfolio. We work with you to identify, purchase, fill, and manage residential properties—so that you can enjoy up to 20% more in rental income with a lot less stress. Learn more about Bungalow.

Ready to find your next home?

Move-in ready homes and a built-in community so you can feel at home, together — wherever you are.

Suggested articles