What is net present value?

Imagine you could afford to buy a home or a multifamily property. Before signing up for a mortgage and spending your cash, you’d want to know if that purchase would pay off down the line.

Net present value is a formula you can use to see how much you should spend on a building (or business) and if it will generate future cash flows. A positive NPV suggests a profitable investment that’s worth the upfront cost. A negative NPV implies future loss, which is a red flag for investors.

Table of contents

Understanding the time value of money How to calculate net present value NPV versus IRRUnderstanding the time value of money

To calculate the net present value of a potential real estate investment, you must first understand the time value of money. Time value of money is a concept that says money you have in your hand now is more valuable than money you’ll have later. This concept is based on two factors:

When you have money today, you can grow it over time, thanks to interest and compound interest.

Money can lose value over time because of inflation.

For example: Imagine you could receive $100 today or $102 a year from now. If you had $100, you could invest that money and generate a return. A year from now, if you earned 5% on your project, you’d have $105.

How to calculate net present value

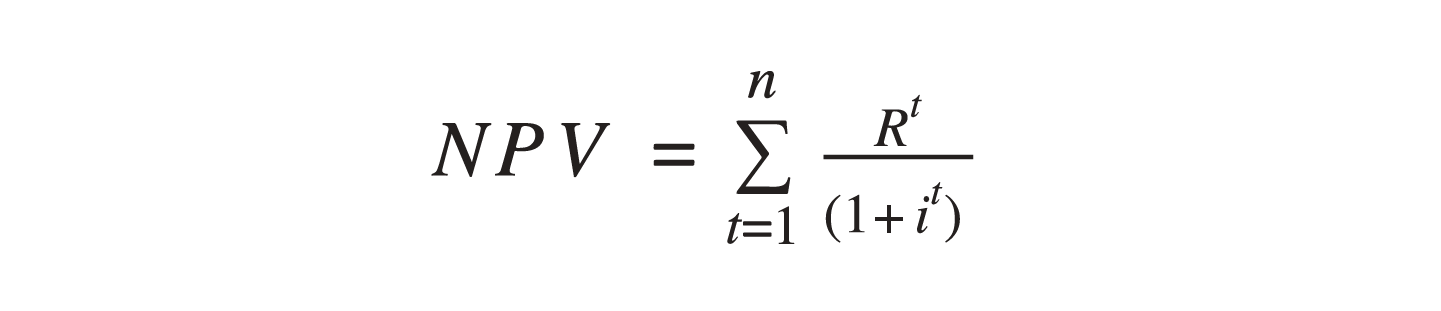

Take a look at the equation for net present value:

In this equation:

“R” is the net cash flow or outflow during a current period of time. Remember you can have negative cash flows.

“t” is the period of time.

“i” is the discount rate or rate of return if invested elsewhere. This is often an opportunity cost based assumption, which means that you are estimating what you might make on other investments you might be foregoing to pursue this project. However, you can also calculate your discount rate based on the weighted average cost of capital.

Put another way, NPV is the sum of each discounted cash flow minus the initial investment.

NPV =cash flow (discount rate or rate of return if invested elsewhere)time - initial investment

How does this work? First, you need to know how much it will cost to start the project. Let’s say you need to put up $10,000 in initial investment to get a business project going (this would be written as a negative number in the equation: -$10,000).

Then you need to know the number of times your project or investment is expected to generate cash flows over a certain time period. You’ll also need to know when to expect cash flows.

Let’s say the business will generate cash once per year for three years. This is your R value.

Year 1 = $3,500

Year 2 = $4,000

Year 3 = $5,000

Now, it’s time to discount these cash flows, or determine how much they’re worth today's dollars. This is how you’ll begin to determine whether your project or investment is worthwhile in the long term.

Let’s assume that you, instead, could invest in another project and reliably make a 6 percent profit on your money per year.

Now, plug it all in. In essence, your NPV calculation is the sum of the initial investment (negative) and all of the discounted cash flows.

NPV = -$10,000 + $3,500(1+.06)1 + $4,000(1+.06)2+$5,000(1.06)3 = $1060

The above NPV is positive, which suggests you will still make a profit on this investment. Keep in mind that this is just an estimate, there could be unforeseen costs or other factors that will affect your discount rate, so this isn’t a foolproof way to estimate profitability.

NPV versus IRR

Internal rate of return (IRR) is another way to calculate the value of an investment. The equations are similar, but while NPV shows the present value of cash your project could generate in dollars, IRR is expressed as a percentage.

When you calculate NPV, you ask: What is the current value of the cash flows I’ll earn on this project? When you calculate IRR, you ask: How much would I need to earn elsewhere to break even on this project?

Generally, the higher the IRR, the better, since you’ll need a profitable alternative to beat your current investment.

If the IRR of your ice cream shop is 15%, for example, you would need another investment that returns over 15 percent to beat it. If your IRR is 5%, you may have an easier time finding a better opportunity.

Bungalow is the best way to invest and manage your real estate portfolio. We work with you to identify, purchase, fill, and manage residential properties—so that you can enjoy up to 20% more in rental income with a lot less stress. Learn more about Bungalow.

Ready to find your next home?

Move-in ready homes and a built-in community so you can feel at home, together — wherever you are.

Suggested articles